“Money can’t buy happiness,” we’re told. Understanding Financial Literacy

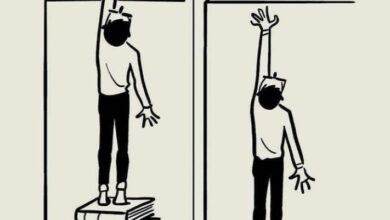

We often hear the phrase, “Money can’t buy happiness.” While that statement is partially true, it overlooks the fact that money can secure the foundational necessities that contribute to happiness—like security, access to resources, and opportunities. While it can’t directly purchase things like deep relationships or compassion, it can provide the means to support and build the lives we want. And no amount of advice from billionaires can change the reality that in our world, money is a necessity for most of our needs.

It’s valid to worry about money. In fact, most of us do. We live in a world where finances determine our ability to access basic needs such as food, housing, and healthcare, along with the so-called “luxuries” like electricity and transportation. According to surveys, financial stress is one of the most common issues people face today, with nearly two-thirds of Americans reporting it as a significant stressor in recent years.

Financial anxiety doesn’t just affect your wallet. It influences your decision-making and can even impact your physical and mental health. But what can be done about it? Because money is deeply intertwined with nearly every aspect of life, addressing it requires more than just practical solutions—it involves reevaluating your emotional relationship with finances.

Related Post

Taking Stock of Your Finances

The first step in improving your financial well-being is by assessing where you stand. List all your debts, savings, income, and assets. It can feel daunting, but this clear understanding is the key to moving forward. Remember, your financial situation is not a reflection of your worth.

Analyzing Your Spending Habits

Once you have a financial snapshot, take a closer look at your spending over the past few months. This step can be uncomfortable, but it’s essential. Judging your past decisions won’t help, but learning from them will. Align your expenses with your personal goals and values—understanding how and why you spend money is a powerful tool for change.

Focus on What You Can Control

Rather than focusing on what’s out of your reach, focus on small, actionable changes you can make right away. Whether it’s canceling unused subscriptions or setting aside savings, immediate steps can provide a sense of control and relief.

Planning for the Future

Once you have clarity on your finances, set realistic goals for the future, such as building an emergency fund or automating savings. Even small changes can create a more stable financial future.

Seeking Help When Needed

Finally, remember it’s okay to ask for help. Whether it’s from a financial advisor or emotional support from loved ones, managing money isn’t a task you have to tackle alone. Money isn’t the ultimate source of happiness, but when managed well, it can provide the stability and peace of mind that allow us to focus on what truly matters. The key is developing a healthy relationship with your finances and learning how to balance pragmatism with emotional well-being.