What Is Money Dysmorphia?

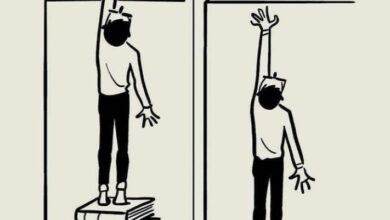

Money is a necessary aspect of life—something that helps us secure shelter, food, and many of the things we need to thrive. Yet, just like body dysmorphia can skew the way people see their physical appearance, money dysmorphia is an unhealthy mindset that distorts how we perceive our financial situation, often leading to anxiety, fear, or denial.

Defining Money Dysmorphia

Money dysmorphia refers to a distorted perception of one’s financial reality. It involves a significant disconnect between how much money someone actually has and how they feel about their financial state. This term is increasingly being used in financial psychology to describe people who, despite having a healthy or even affluent financial situation, feel as though they are financially insecure, broke, or in crisis.

Think of it as a form of financial anxiety where individuals believe they don’t have enough money, even if they do. This can manifest in obsessive behaviors around saving, extreme frugality, or constant worry about future financial security. On the flip side, some people with money dysmorphia might overspend or go into debt because they don’t recognize the limits of their financial resources.

How Does It Happen?

Money dysmorphia can develop from several factors, including:

- Upbringing: Childhood experiences and how our parents or caregivers handled money can significantly shape our money mindset. Growing up in financial instability, for example, can lead to a scarcity mentality, even when someone has attained financial success later in life.

- Society and Culture: We live in a society where consumerism and material success are often highly valued. The pressure to “keep up” with peers, especially in a world of social media, can lead to distorted views about what is “enough.”

- Psychological Influences: Just like body image issues can be influenced by underlying anxiety or self-esteem problems, money dysmorphia can often be a symptom of larger emotional or psychological challenges, including a need for control, fear of losing what one has, or feelings of inadequacy.

Related Post

Signs of Money Dysmorphia

Some common signs of money dysmorphia include:

- Constant Fear of Running Out: Even if you have a steady income or savings, you may feel anxious about money running out or the fear of not having enough in the future. You might check your bank account frequently, even though nothing has changed.

- Feeling Poor Despite Wealth: People with money dysmorphia often struggle with feelings of being financially insecure, even when they have a stable income, investments, or savings.

- Obsessive Saving or Hoarding: The person may save excessively or refuse to spend even on essentials, constantly worrying about financial collapse.

- Overspending or Denial: In some cases, individuals may deny the reality of their financial situation and overspend, ignoring debts and future obligations.

- Difficulty Feeling Content: No matter how much wealth or financial success is achieved, there’s a lingering feeling of inadequacy or lack.

The Impact of Money Dysmorphia

Having a distorted perception of your financial situation can take a toll on your mental health, relationships, and overall well-being. It may lead to:

- Chronic stress and anxiety: Worrying about money constantly, even when there’s no immediate reason to.

- Relationship strain: Disagreements over money can create tension, especially if one partner has a more realistic financial view and the other is driven by fear or denial.

- Missed life opportunities: Those who save obsessively might miss out on enjoying experiences or making investments that could enhance their quality of life.

How to Address Money Dysmorphia

Dealing with money dysmorphia starts with recognizing that your perceptions may not align with reality. Here are a few steps to help:

- Acknowledge the Issue: The first step in tackling money dysmorphia is to realize that your fears or behaviors around money might be exaggerated. Recognizing the emotional component of your financial behaviors can help open the door to change.

- Work with a Financial Advisor or Therapist: Just as therapy can help those dealing with body image issues, working with a financial therapist or advisor can help you unpack the deeper reasons behind your financial anxiety or denial.

- Create a Clear Financial Plan: Having a plan in place with clear goals for saving, investing, and spending can help ease financial anxiety. Seeing the numbers in front of you—especially with the guidance of a professional—can help clarify what’s real and what’s perceived.

- Practice Mindfulness: Regular mindfulness practices can help alleviate anxiety around money by grounding you in the present moment and helping you manage the emotional component of financial worries.

- Educate Yourself on Financial Wellness: Sometimes, money dysmorphia can stem from a lack of understanding about your financial situation. Increasing your financial literacy and regularly reviewing your budget and accounts can help combat unnecessary fear.

Conclusion

Money dysmorphia can distort the way you view your finances, leading to unnecessary stress or denial about your financial health. By acknowledging this mindset and taking steps to address it—whether through therapy, financial planning, or self-awareness—you can begin to develop a healthier relationship with money and achieve both emotional and financial well-being.